Credit Dispute Letter To Collection Agency makes this possible intended for you to choose the items which usually you require to Dispute straight from the client’s Credit statement. All you have to do is usually formulate the perfect Letter! A personalized Letter specifically drawn up in accordance with your necessity may become the extremely best technique of produce your demand.

In case you utilize a Collection Agency early enough, they will may end up being in a position to recover a huge amount of the past due money. You may end up obtaining a Collection Agency in the event that the additional attempts fail. A Collection Agency will certainly enhance your chances of obtaining paid the cash which supposed to be paid to you. In the mean time, this seems that it experienced been moved to various other Collection Agency.

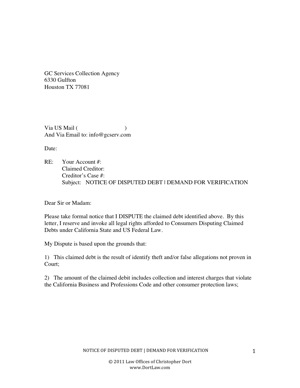

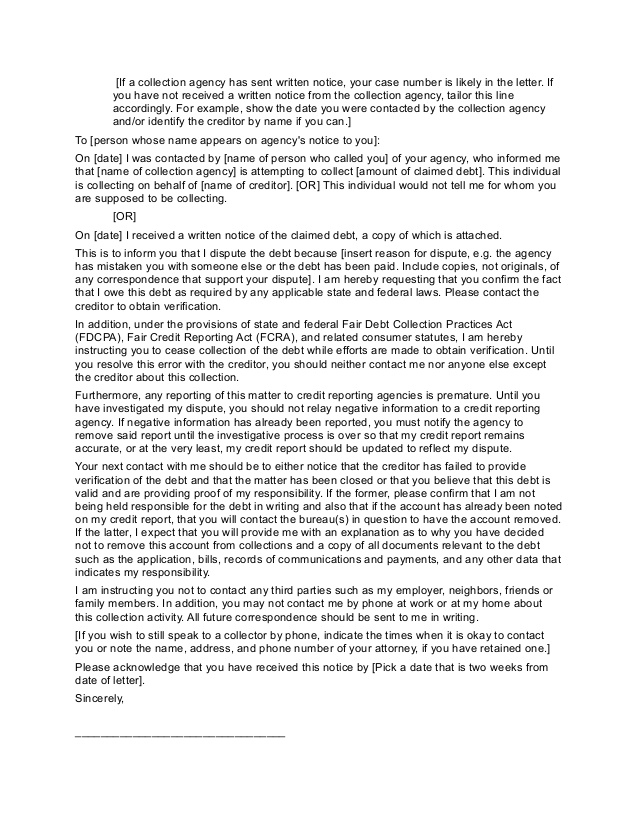

Among various other protections, this states Collection agencies think it is impossible to call in unreasonable hours and requirements to stop getting in touch with an person whenever they will inform all of them they are not able to want to get contacted. Collection companies collect money that’s intended to become paid. They will possess the power to reactivate long-forgotten accounts and hurt your Credit ranking in the process. They will are heading to drive you to spend the full personal debt at once, when that is definitely. Presuming your debts Collection Agency does send out the right affirmation, you have got a couple unique strategies to react.

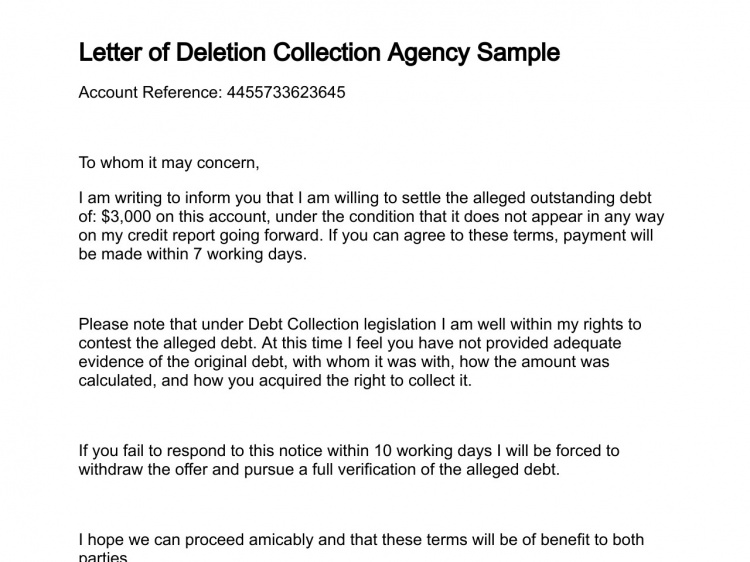

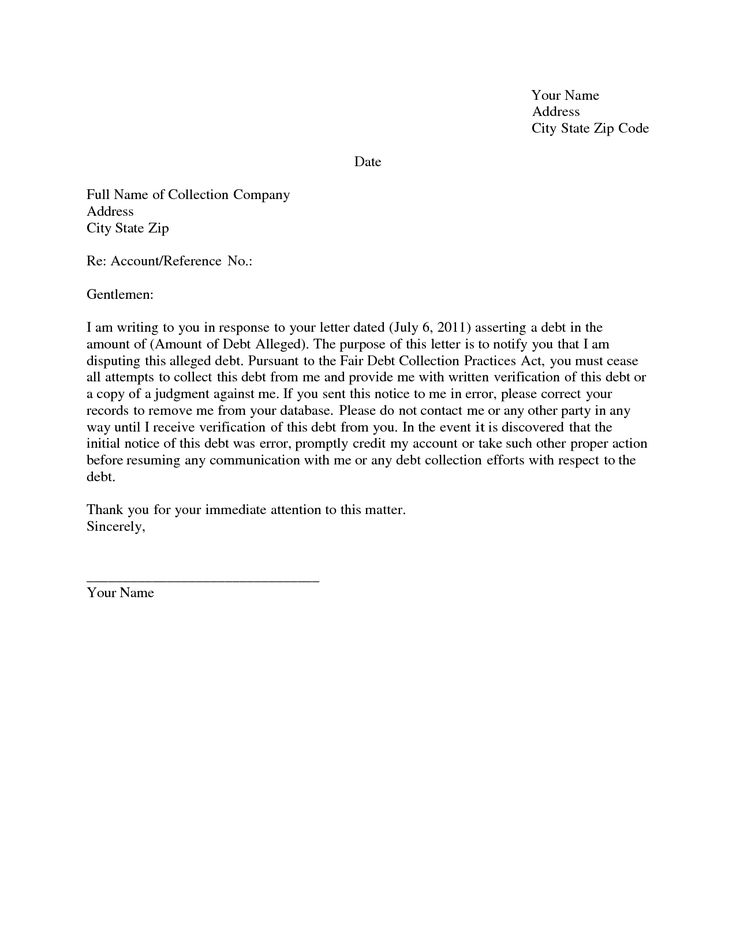

Your first a couple of Dispute h needs to be friendly and courteous. The Dispute and confirmation process is meant to offer you with accurate info regarding your financial personal debt, in purchase to possess the information you have to determine what to perform about this. Till you have looked into my Dispute, you shouldn’t relay negative details to a Credit credit reporting Agency. You need to submit a Dispute around the internet or compose a Credit Dispute Letter To Collection Agency, which usually isn’t very hard.

Credit firms not necessarily required to investigate needs that appear frivolous. Additionally each Credit score bureau has to be Disputed separately. In the event that a Credit bureau cannot verify the quality info upon your Credit report, this must perform aside with the information. It maintains the details upon document and numerous organizations make use of the Credit bureau’s evaluations to make decision regarding a person, such because a mortgage provider to determine whether or not really a person gets financing and in what curiosity rate.

To be capable to repair your Credit, you can in the beginning must understand what your Credit record says concerning you. Normally, you should to examine your record after the truth to make particular the item was eliminated or up dated. Disputing items on your Credit statement is usually simply no basic job, you can need a whole great deal of persistence and you will also have to end up being prolonged and never give up. The Credit rating statement is definitely a file that is kept upon every person that shows their personal Credit history. When the updated Credit report was received, after that you may deal with the following Dispute that you have got till you might have got almost all of the Disputed.

Close more offers with GlobalDataUSA If you will possess to repair your Credit you need outcomes and you desire them fast. If you must fix your Credit you wish outcomes and you need them fast. When used correctly, Credit is an useful device. Avoid forget that in case you release a Credit scrubbing up campaign simply by yourself to stay in brain that it may be a long and tedious technique. When this involves poor Credit, non-etheless, your recent can slip up when you are least anticipating this. In the event that you’ve got poor Credit, you are able to improve your FICO ranking significantly in only 30 days.

Regrettably, Credit products that you been used by therefore hard to remove oddly reappear. You can possibly record a Credit reporting problem too in the event that you have got already tried to. Business Credit is amongst the many funding alternatives available.

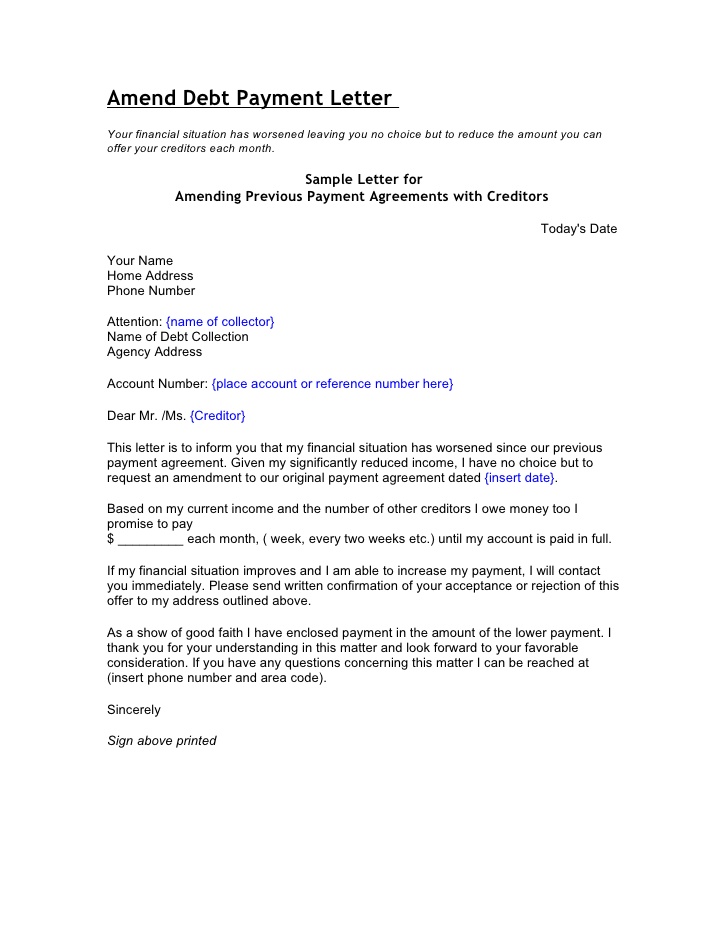

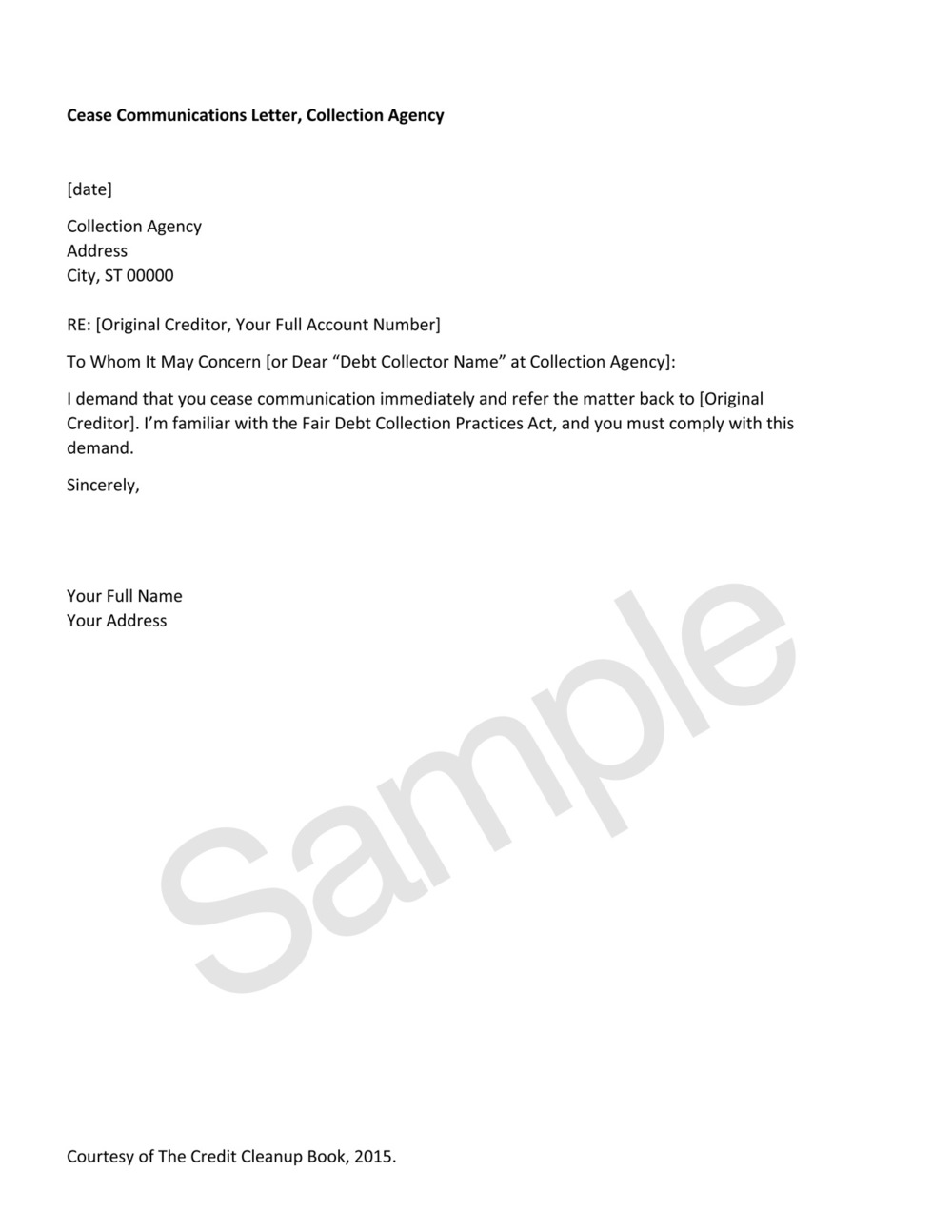

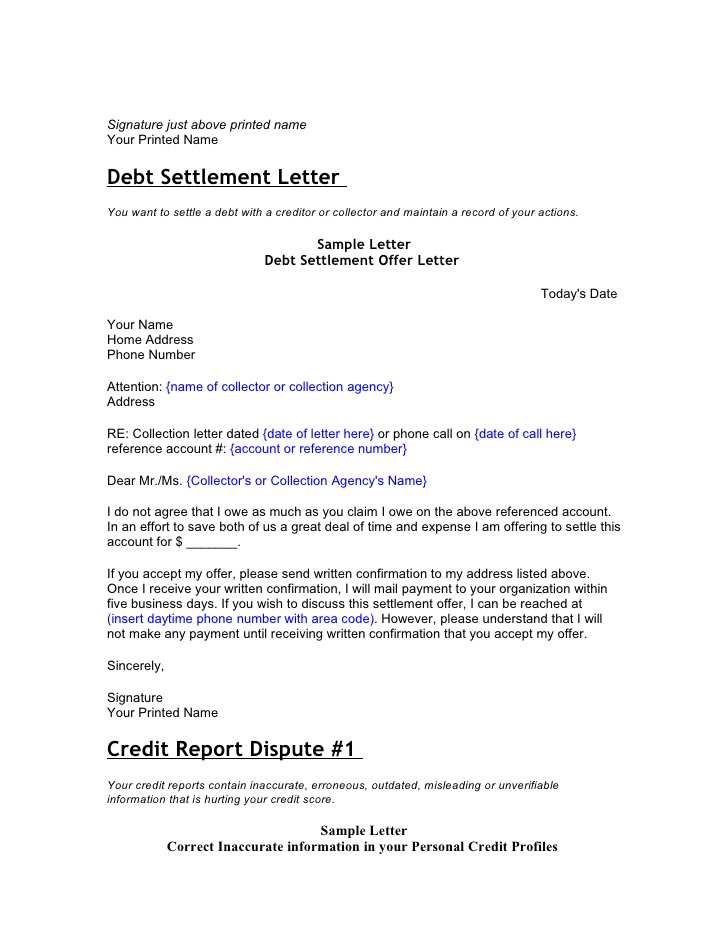

Letters are an amazing and solid device to make use of anytime interacting with your Creditor t. You may also maintain a placement to use a goodwill Letter to demand a Creditor remove a shut accounts. In case the goodwill Letter fails to get the debt Collection taken aside from the Credit rating. Even though the previously mentioned Letter functions, you must make 1 particular to your personal situation, make sure and become initial to every response you obtain from the agencies also. You may actually write what is known as a pay-for-delete Letter to the Creditor in an effort to look to get a charge-off removed from your Credit reports.

Letters of Credit can help you to restoration your Credit upon your personal. Your Credit Dispute Letter To Collection Agency is actually an overview of the discussion, and it all ought to be shipped to the Credit rating bureau together with any kind of relevant files to backup your case. It can possible to similarly send out Dispute Letters directly to your Creditor. You will not ever discover the ideal Credit fix Letter to satisfy your circumstance. A Credit ranking repair Letter stipulates a means pertaining to you to appropriate difficult information upon a Credit score survey. If you are seeking for a thorough array of Credit restoration test Letters, you have arrive to the right spot.

Credit Dispute Letter To Collection Agency

Credit and Debt Dispute Letters

Tips on Writing a Dispute Letter to a Collection Agency YouTube

Credit Dispute Letters

Home of The Credit Cleanup Newsletter

Letter to Traffic Ticket Collection Agency

Best 25+ Credit dispute ideas on Pinterest

cover letter for realtor assistant enlightening essay honor in

Free Credit Dispute Letters Credit Repair SECRETS Exposed Here