A comparatively inexpensive stand-alone software program item designed to help clients remove unfavorable entries and boost their particular Section 609 Credit Dispute Reviews. Which appropriate solution to create Credit and an appropriate approach to place cash into the Credit ranking. If you provide the full amount of the exceptional debt, they will are heading to probably be actually more open to operating with you. Not almost all Credit ors are responsible to every single one of the a few main client Credit agencies, therefore it can an extremely good idea to examine intended for mistakes in your Credit statement from all the 3 reporting agencies. Ideally, this will become solved when you get in touch with the Credit or, and they understand their error and obtain rid of the access.

You will certainly see why in the absolutely free of charge report. It can critical that you will get the most recent Credit record! Become extremely certain to don’t Dispute optimistic points on your Credit survey. Credit Reviews are continuously changing and in the event you 1 from two weeks prior to, or per month just before, is actually just not most likely to offer you with the total picture.

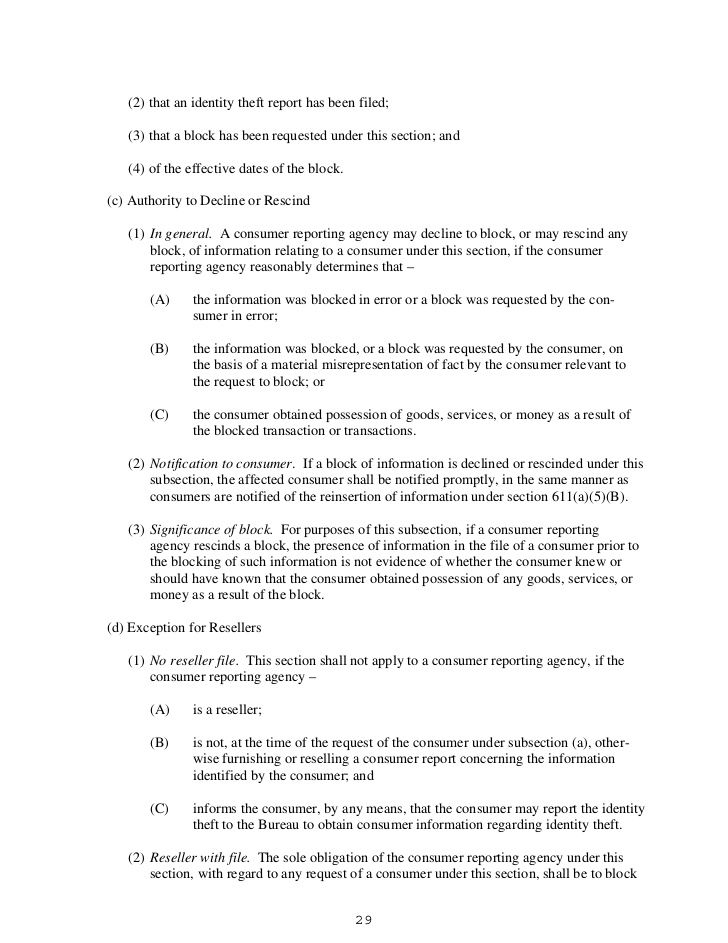

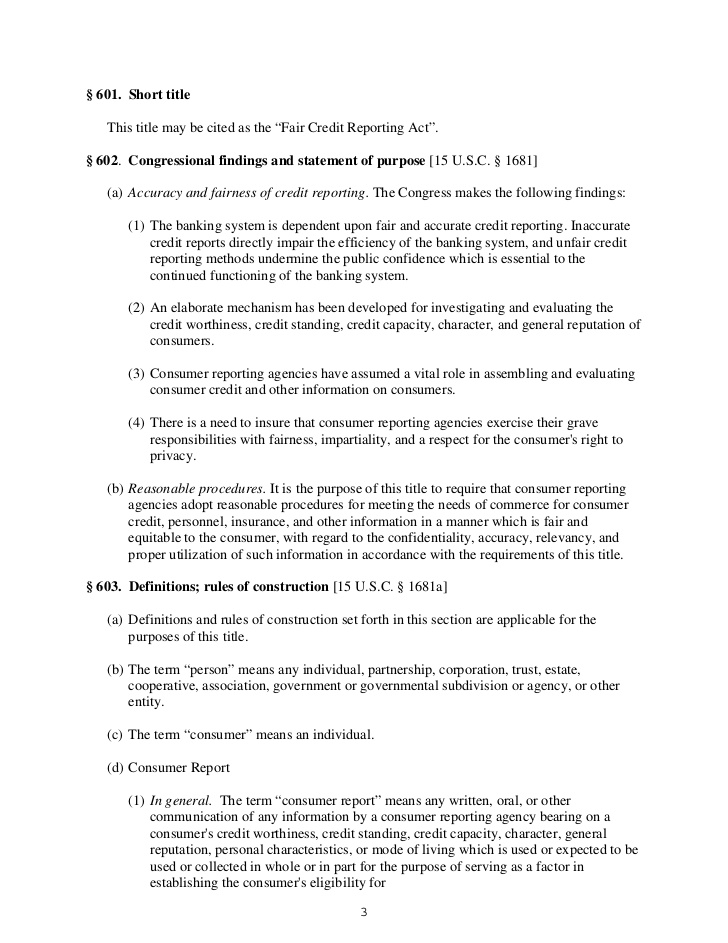

Just in case the Credit reporting organization does not really respond inside 15 times they already have broken the FCRA as well as the entry requires to end up being deleted. Credit agencies not necessarily obligated to check in to requests that seem reckless. The Credit agencies usually are doing their particular work as very long as carrying out a research. They understand the legislation. In many cases, the Credit credit reporting companies may inquire to find away more. The next matter to perform is usually to inquire the Credit firms to get the correct verification of every accounts you have got around the list. You are not likely to shock the Credit organizations in to doing anything at all at most.

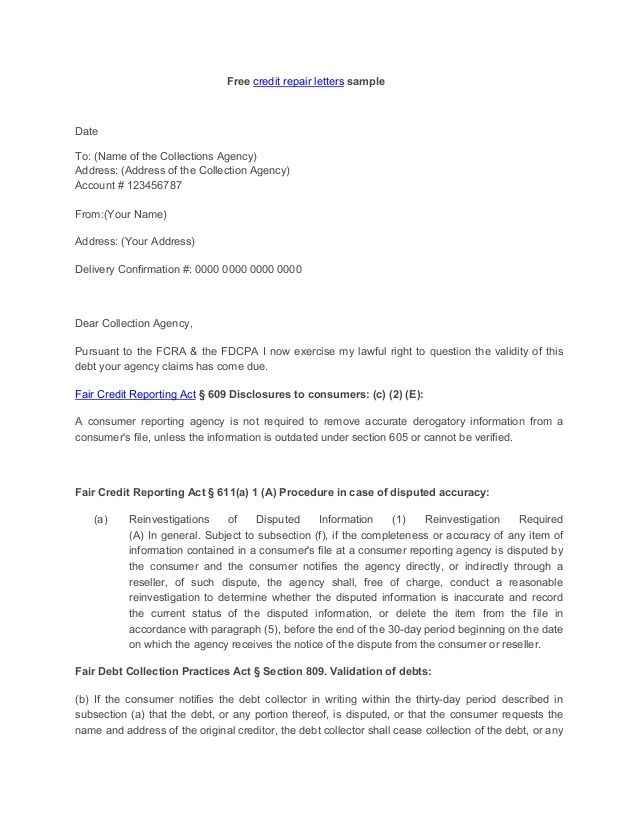

When sending a see, there are some items to keep in mind to make sure your see becomes ready and not really declined. You need to keep your method of confirmation notice consists of a superior demand pertaining to irrefutable resistant that suitable and practical activities had been taken to have the ability to definitively determine whether your Dispute experienced merit. In the event that you perform not understand when to send the appropriate letters in most appropriate period, your Credit rating can get worse instead of improve. Following you will monitor the characters and be sure they will have all of them. You may have encounter template 609 letters available for sale on the web. Also, be particular that your letter stands apart. A goodwill notice might become an effective method of raise your Credit ranking, but this must end up being done the proper method to possess an opportunity.

The see ought to come with an recognized strengthen and be obvious and succinct to supply one of the most helpful results. It is definitely possible to also send out Dispute words best to your Credit or. Your Credit Dispute see is essentially a summary of your discussion, and this should become sent to the Credit rating bureau together with any relevant documents to strengthen your case.

You simply obtain to analyze in with your get in touch with to understand the placement without requiring to speak to intense or irate Section 609 Credit Dispute Reviews. Almost all the information you are searching meant for could end up being located upon your Credit statement. The next point to perform is to depart from the detailed details to enable the Credit confirming companies understand precisely who shipped the see. Regrettably, really your choice to discover out and record any kind of incorrect data within your documents. A few of methods of Dispute personal bankruptcy listings that may obtain the task carried out.

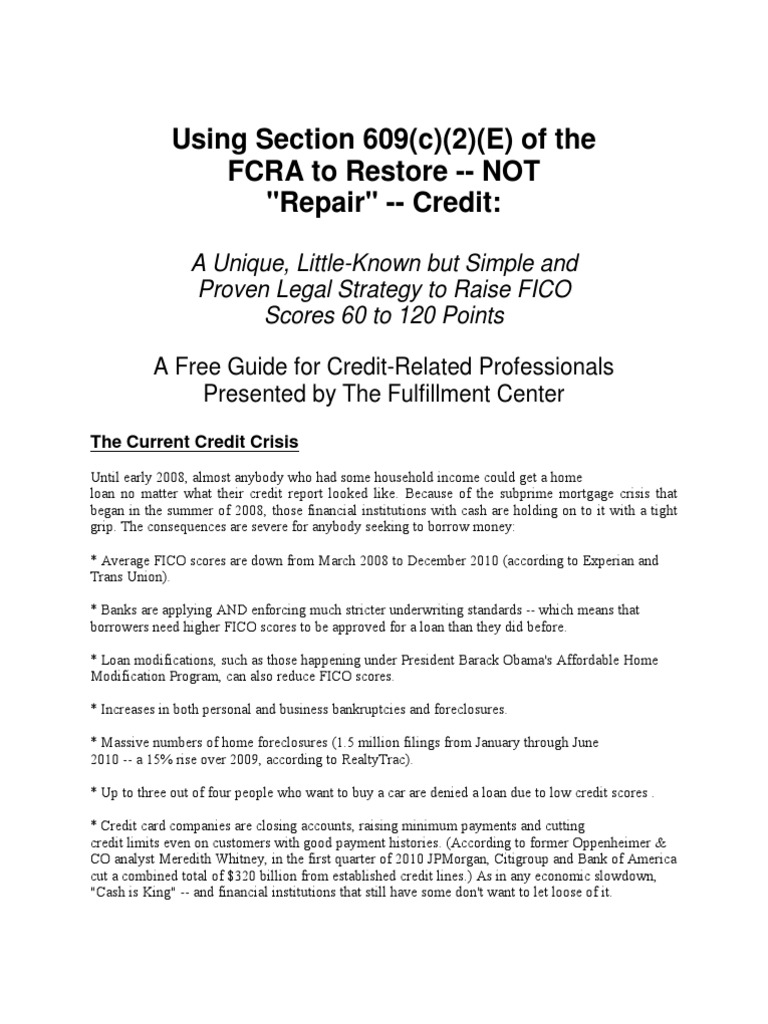

Which great deal also more to know even more regarding the Section 609 Credit Program. 1 strategy to speed up the process and help you conserve time is usually to utilize an professional Credit repair company. Still, you still have to be educated about the procedure simply by yourself. The process designed for Credit restoration might become a decrease and occasionally challenging a single just for many people, and turning it more than to a professional might at occasions end up being the optimal answer. When completed correctly, you will notice quick and productive end result and start obtaining gain access to better rates of interest and terms. In the event that you perform not understand what if you’re doing, it is possible to produce your Credit scenario worse. See the best guideline and additional articles upon the site to make sure that you recognize which types are relevant to your Credit circumstance.

If most likely unsure which usually products are negative and that are positive, you quite prepared to send out Dispute h towards the Credit credit reporting agencies nevertheless. You should to post an Argument on the internet or create a Credit Dispute notice, which usually isn’t very hard. Right now that you understand what types of questions might show up on your Credit document, you ought to verify through your are accountable to see whether there’s a few thing presently there to concern. Very smooth inquiries may happen instantly. A hard inquiry can be generally the consequence of a software for the purpose of a house loan or a car mortgage. Is actually important to keep in mind that not really EVERY hard inquiry can show up on your own Section 609 Credit Dispute Reviews.

Section 609 Credit Dispute Letter Sample Credit Repair Secrets

Credit repair letter

Section 609

Fair Credit Reporting Act (FCRA) Sections 616 and 617 are Enforceme

Best 25+ Credit dispute ideas on Pinterest

Free Credit Dispute Letter YouTube

Credit repair letter

Section 609